Most Investors Will Miss the Real Profits in Gold…

Here is How You Can Maximize Your Position

for Gold’s Violent Move Higher in 2017

Dear Reader,

I own gold not because I think I will make a profit, but for insurance purposes, because I know that everything we are being told about our economy is a lie. And one day, not too far from now, the currency, the pumped-up markets, and the price inflation in assets are all going to implode!

what will trump in these times!

This is why I have positioned myself and my family with the ultimate insurance against central bank stupidity and global monetary experimentation.

I also plan to profit, and not just a little bit… I am not looking for a double or triple, as the truth is gains like that really don’t excite me. It’s why last year, one of our top investments related to gold yielded 7.5x the gain of gold.

For 2017, gold is up 10%, but our mineral bank, with a robust portfolio of world class gold assets, is up 25%! A $10,000 order of gold at the start of 2016 is now worth $11,584. It’s not a bad return, and certainly nothing to complain about. But as many of you reading this letter know, a $10,000 investment into our gold mineral bank suggestion is now worth over $30,000!

This is why I stress to everyone who will listen that if you’re looking to profit from the rise in the gold price, DON’T buy gold. Gold is money, and it’s a great hedge against all the problems that are coming our way, but I assure you, no one owning gold is going to see a massive increase in their net-worth.

Another Possible Billion-Dollar Giant

This isn’t the first time investors have sought Keith out in order to make a fortune… In the 1990s, he started First Quantum Minerals, turning it into a billion-dollar giant!

In the early 2000s, he founded First Majestic Silver, his second billion-dollar company, and to this day, it is still the go-to stock for silver investors.

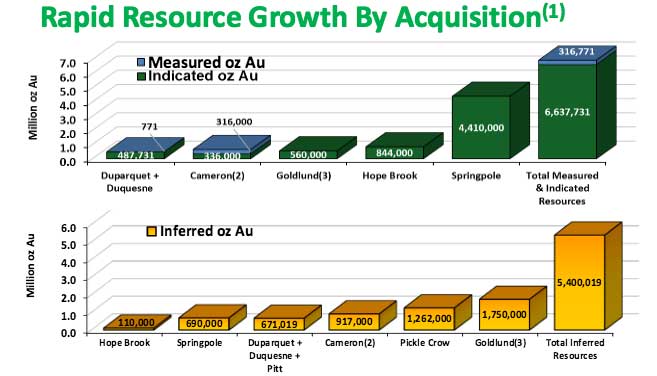

Now, he’s turned his attention to building the ultimate gold mineral bank – a company with gold resources in the ground, buying up gold for less than $10 per ounce! Keith and his team have taken advantage of the depressed gold market by launching in 2015 and going on an unprecedented acquisition spree.

Just 1 asset, in 2012, was valued close to what the entire company is today, and First Mining Finance now has 25 projects. This includes one of the largest, undeveloped gold deposits on earth!

I don’t think anyone has seen a business plan executed so well.

When First Mining Finance launched, they had zero ounces of gold… Keith Neumeyer laid out clear objectives: acquire gold assets from distressed sellers and build a mineral bank, unlocking incredible value to shareholders as the gold market turns higher, with joint ventures, royalties, and even spinouts of some of the projects.

If you’re looking for a great gold stock, First Mining Finance is the perfect marriage between great assets and an exceptional management team that is made up of very serious mining executives and geologists.

Other companies today are paying upwards of $50 per ounce of gold in the ground. First Mining Finance has always paid less than $10, and has even purchased gold resources for as low as $3.80 per once! As gold rises, it will be the shareholders of First Mining Finance and the investors who partner with people like Keith Neumeyer who will be rewarded.

Our Recommendation: Consider Buying Shares of First Mining Finance

up to CAD $1.25 & USD $1.00.

- Physical supply is tight!

- The number of discoveries has collapsed.

- Goldman Sachs believes peak gold production was last year!

- Industry-wide, gold is becoming nearly impossible to find…

- And to add to the demand for gold, we have China, the U.S., and Europe teetering on massive debt crises.

- Zero-percent interest rates

- High debt levels (both private and government)

- All of the 2008 problems remain unresolved

- BREXIT, and possibly the end to the Euro currency in 5 years

- U.S. Federal Reserve monetizing debt (printing money to buy Treasuries)

- Peak gold is here, according to Goldman Sachs

- China and Russia are buying gold assets up at record paces

Best Regards,

Daniel Ameduri

President, FutureMoneyTrends.comEditor’s Note: I own shares and am long First Mining Finance. I personally only own the stocks covered in the Future Money Trends letter.