I’ll Be Disappointed if We Don’t See a 200% Return

I’ve been looking at this chart for hours – it says it all, and I want you to get a full grasp of this because in February of last year was when Wealth Research Group last touched on this subject and the subsequent boom brought six 300%+ winners to our newsletter by August.

Now Keith Neumeyer, who is basically Mr. Silver, sent me this chart last night and asked me to make sure that people that are important to me have a chance to examine this, so I immediately made it a top priority to get this to you.

The bottom line is we’ve entered that unique stretch of time in which silver is absurdly cheap and will outperform all other metals for a brief — but insanely profitable — time frame.

I want to show you three major components of this bullish silver move and the one obvious conclusion to draw from them:

- The Gold-to-Silver Ratio: As you can see in the chart above, the 80:1 support for silver is like a brick wall, and when reaching it, silver bounces back and outperforms gold for 1-3 years.

The key to understanding momentum and capturing these invaluable moments is that junior mining shares outperform both of the metals when silver outperforms gold.

Let me repeat: When silver outperforms gold, the mining shares outperform them both radically.

The perfect investment for this surge in silver price is the ultimate and purest silver miner, First Majestic Silver (NYSE: AG & TSX: FR)!

There’s no need to get complicated or oversophisticated when picking the ideal company for this silver price explosion.

Keith’s company is my No. 1 way to ride this wave with safety and maximum leverage.

- ETFs and Institutional Buying: You can rest assured that we’re not the only professionals who are reading the map correctly and connecting the dots.

First Majestic Silver (NYSE: AG & TSX: FR) is a component of most mining ETFs, most commodity-related hedge funds, pension funds, and even the world’s most conservative central bank, that of Switzerland, owns shares and will be looking to increase their position.

We’re talking about world-class institutions hitting the bid here – judging by history, when silver soars, this company makes new highs, plain and simple.

In 2016, holding First Majestic was smart, and with one click of a button you gained a front-row view of how a well-managed company receives investors’ full attention.

Consider First Majestic (NYSE: AG & TSX: FR) shares now – it’s about timing this perfectly!

- Sentiment: Some investors are permanent bulls on precious metals, which is a horrible mistake, specifically with natural resources, which are cyclical by nature.

It’s exactly why we sometimes avoid new investments altogether, at other times we short ETFs, and sometimes we decide to dollar-cost average into quality companies. When all the lights turn green, we know how to get aggressive.

The best time to become focused and zoned in is when your peer investors are fed up, and this is happening now.

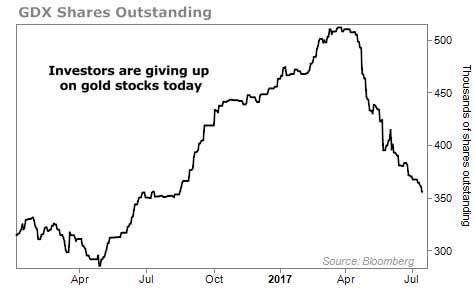

When the shares outstanding are rising, it means investor demand exceeds supply and gold stocks are loved.

When this number is falling, such as today, investors are throwing in the towel.

You can see that gold investors finally started giving up on gold stocks in April and they’ve continued to surrender to their emotions.

This is a gift given to us by those with less conviction and education regarding market cycles, and we’ll take it any day of the week.

Silver is cheap, despised, and climbing in price – the classic contrarian signals to load the weapons.

It’s time to consider owning the queen of silver miners: