Dear Reader,

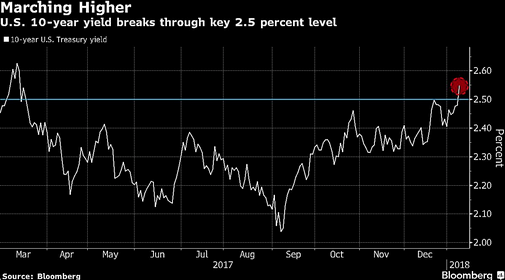

A day after the bond market showed major technical signs of ending its 36-year bull run, Bloomberg is reporting that senior government officials in Beijing have recommended a slowing — or even halting — of future purchases of U.S. Treasuries.

Bond investors were already turning bearish, so in our opinion, this news will simply solidify the move we have been seeing.

In fact, for the first time, bond king Bill Gross declared that the bond bear market had begun and said he’s gone short Treasuries.

This all makes sense, by the way. With the global economy improving, the defensive havens, like U.S. Treasuries, are being sold. Besides equities, gold will be a big beneficiary to this because we are going to see added weakness to the U.S. dollar during this time.

China, the largest producer of gold, saw its imports of gold surge 50% last year. In India, that number was even higher, at 67%!

Since the election, Russia has also increased its gold stockpile by 54%.

The set-up for gold and silver here in 2018 is better than I’ve ever seen!

Best Regards,

![]()

Daniel Ameduri

Editor’s Note: To see our 3 recent precious metal stock suggestions, click here.