Income Champions: 8% Yield Stocks

– Core Portfolio Blueprint –

Governments have historically created programs that endure until they don’t anymore, when cracks appear and systematic failure causes collateral damage to the population. The reason this keeps on happening is because of one political truism that is totally fruitless and goes against any sensible standpoint that we hold about the business world: short-term thinking applied to long-term issues.

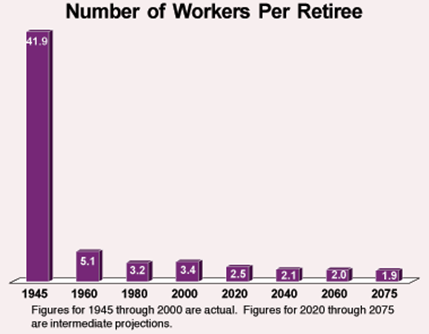

When you couple this with the bureaucracies of officials, the adaptations are extremely slow and the negative ramifications are needlessly painful and harmful. Here’s the thing: presidents get elected to a 4- to 8-year term and then disappear into the shadows, but the policies they institute into law live on and stay in affect. Social Security, for example, only works when a certain ratio of workers to retirees prevails. Workers funnel the Social Security fund with liquid cash; so that retirees can be paid after all administrative costs have been extracted.

The worker-to-retiree ratio used to be 7:1 after World War II, but today, it’s nearing 2:1.

In essence, governments over-spend in hopes that they can satisfy today’s citizens and in the future, the increase of population that can be taxed will fund the leverage and loans taken today. What happens when future tax receipts can’t?

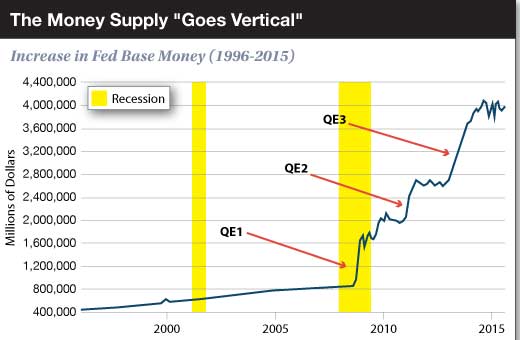

This is exactly where we are today, but since the monetary system we live by is a clear double standard — where governments and multinational banking corporations aren’t subject to the same laws as the average person — they are allowed to keep this over-leveraged position for an extended length of time and attempt all sorts of “new solutions” to a problem rooted in false fundamentals, with currency that is backed by nothing.

This problem is too large to tackle with the “regular” toolkit, but the bankers keep on trying. Lowering interest rates to such a low level is one their last tools.

This is also a major concern for pension funds and retirees. Instead of saving $1M that generates $50,000 a year from bonds or interest to spend annually for 20 years of retirement, they want to save an additional $1M to make up for 20 years of lost income ($50,000 * 20 years of retirement).

Saving by the private sector is the reason why the government is printing currency. Ultra-Low rates and currency printing are theft – plain and simple.

When the economy is entirely uncertain and full of pervasive central bank policies, it is outright stealing by inflation and manipulation.

Wealth Research Group’s core belief is that with careful due-diligence, any financial challenge can be overcome. In my Personal Game Plan for 2016: 4-Seasons Portfolio, as well as in the Defense/Offense Portfolio, and lately in the Fortressing for Retirement series, I emphasized the importance of investing in high-yield financial assets.

One of the core strategies of a balanced portfolio is obtaining high-yields stocks with at least 20% of your funds.

Residential real estate is one option, but if you want a hands-off approach that allows you to earn high yields, there’s a certain group of companies that are a perfect fit. These companies grant you instant leverage to the talent of people, liquidity of stocks, specialty markets that are safe and trending up, and the expertise of seriously experienced management teams. What you’re looking for are Income Champions Stocks.

Wealth Research Group has dedicated a tremendous amount of effort into finding the most prolific Income Champions.

All portfolios are based on defense first, in the form of physical gold and silver. Then, portfolios need stocks that compound wealth for decades. Next, portfolios need Income Champions for current income. Finally, all savvy investors are constantly on the lookout for Smart Speculations that have such a dynamic and mind-boggling potential of gains that the utmost seriousness must be applied to them.

After much research, we have found two companies that yield more than 8% each. It’s the quintessential definition of ideal Income Champions stocks.

These companies should be a core holding – their prime objective is income. Wealth Research Group is a company that is focused on solutions, and our main mission is to provide the tools for you to strengthen your Financial Fortress.