[vc_row parallax_content=”parallax_content_value” parallax_content_sense=”30″ fadeout_row=”fadeout_row_value” fadeout_start_effect=”30″ enable_overlay=”off” seperator_enable=”off” ult_hide_row=”off” css=”.vc_custom_1458927810624{margin-top: 0px !important;margin-right: 0px !important;margin-bottom: 0px !important;margin-left: 0px !important;border-top-width: 0px !important;border-right-width: 0px !important;border-bottom-width: 0px !important;border-left-width: 0px !important;padding-top: 0px !important;padding-right: 0px !important;padding-bottom: 0px !important;padding-left: 0px !important;background-image: url(https://www.futuremoneytrends.com/wp-content/uploads/2016/03/Lithium-X-Background.jpg?id=138292) !important;background-position: center !important;background-repeat: no-repeat !important;background-size: cover !important;}”][vc_column][ultimate_spacer height=”20″][vc_column_text css=”.vc_custom_1458928116411{margin-top: 0px !important;margin-right: 0px !important;margin-left: 0px !important;border-top-width: 0px !important;border-right-width: 0px !important;border-left-width: 0px !important;padding-top: 25px !important;padding-right: 0px !important;padding-left: 0px !important;}”]

It’s Been 115 Years Since Investors Had an Opportunity Like This!

The Rockefellers, the Vanderbilts, and Henry Ford made a fortune from the last energy-powered vehicle revolution.

Now, Frank Giustra, Paul Matysek, and Elon Musk are set to help pave the way to the rise of a new technological era for modern energy! We are talking about the oil of the 21st Century… something that will power the future and make investors a fortune!

[/vc_column_text][vc_row_inner][vc_column_inner][vc_column_text][su_note note_color=”#fcfcfc” text_color=”#000″]

Lithium X (TSXV: LIX & US: LIXXF)

You’re About to Enter Into a Trend that Could be Life-Changing!

Chairman Paul Matysek is a major winner for us to get behind,

coming off of a recent lithium deal where he helped investors turn $10,000 into $155,000 in 2 ½ years!

[/su_note][/vc_column_text][/vc_column_inner][/vc_row_inner][vc_single_image image=”138289″ img_size=”full” alignment=”center” css=”.vc_custom_1458928193577{margin-bottom: 0px !important;border-bottom-width: 0px !important;padding-bottom: 0px !important;}”][/vc_column][/vc_row][vc_row][vc_column][ultimate_spacer height=”15″][vc_column_text] Dear Reader,

Dear Reader,

In 1901, oil went mainstream. From there, fortunes were made and our world was changed forever. On October 1st, 1908, just 7 years later, the Ford Model T was introduced. It was simple to drive, and priced right. By the 1920s, the majority of American drivers had learned to drive on the Model T.

As with all of our great technologies, the value and utility of the Model T increased every year, but the price dropped consistently,going from $22,000 in today’s dollars in 1908 to $7,800 by 1916.

I have no doubt that Elon Musk, of Tesla, is the Henry Ford of our time. Last year, he announced Tesla Energy, a new wing of Tesla Motors that will focus on lithium batteries for homes and businesses. And honestly, he has the entire world behind him – every government on earth is pouring money into sustainable, clean energy.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_column_text][su_note note_color=”#fcfcfc” text_color=”#000″]

I Believe Lithium X (LIX), like no other company,

is Positioned to Profit from this Massive Trend

[/su_note][/vc_column_text][vc_column_text] [su_list icon=”icon: check” icon_color=”#0000″]

[su_list icon=”icon: check” icon_color=”#0000″]

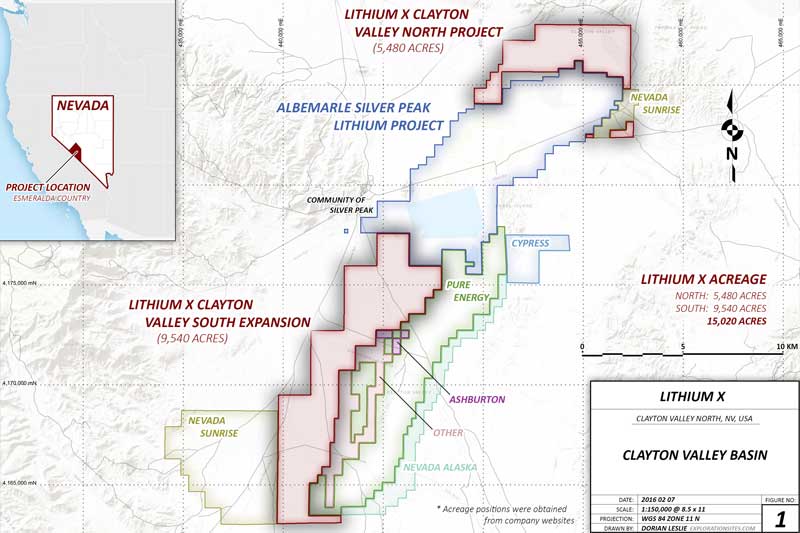

- LIX has the largest land package in North America, located near Elon Musk’s Gigafactory in Nevada.

- They’ve also just acquired a South American project that could produce over 15,000 tonnes annually!

- Bloomberg Business recently announced that “Prices of lithium carbonate have jumped about 250% in China in the past year, hitting $24,500 a ton.”

[/su_list]

Do the Math… and the Team is on the Hunt for more Assets…

Lithium is the lightest metal on earth, and is already used to power our cell phones, laptops, and iPads. And now, companies like Ford Motor, Toyota, Panasonic, and LG are moving into the lithium-ion battery sector in a way that will not just change how their company products are powered, but will essentially change history for all of humanity!

This is why we truly haven’t seen an investment opportunity like this in over a hundred years. Not since oil in the early 1900s has there been such a ripe moment for you to buy a natural resource that is about to change the world.[/vc_column_text][vc_column_text]

“The era of the electric car promises a lithium-mining boom” — Fortune

[/vc_column_text][vc_column_text][su_note note_color=”#fcfcfc” text_color=”#000″]

Lithium Demand

[/su_note][/vc_column_text][vc_column_text] Lithium demand is up over 300% since the 1990s, and that’s just new demand largely coming from our computers and cell phones… Remember, prior to a few years ago, the world had mostly never heard of Elon Musk, even though he had already changed most of our lives once, with the money transfer service called PayPal.

Lithium demand is up over 300% since the 1990s, and that’s just new demand largely coming from our computers and cell phones… Remember, prior to a few years ago, the world had mostly never heard of Elon Musk, even though he had already changed most of our lives once, with the money transfer service called PayPal.

One day, the majority of vehicles will be battery-powered, so you have to consider the type of demand this natural resource will see over the next decade – and then the next 4 or 5!

A single electric car requires about 3,000 times the lithium needed in your cell phone. This is serious business; China alone is spending $1.5 billion in order to build charging stations in anticipation of a world run on lithium-powered cars. And now, Tesla is planning on powering every home in America with a lithium-powered battery if they can, through their new division, Tesla Energy.

This boom for lithium demand and use is happening, and it’s just the beginning!

[/vc_column_text][vc_column_text][su_note note_color=”#fcfcfc” text_color=”#000″]

Insiders

[/su_note][/vc_column_text][vc_column_text]LIX has probably one of the most successful investors alive as an early investor and co-founder, Mr. Frank Giustra. You have probably crossed paths with some of his businesses, too; not just the natural resources they produce, but also his very popular entertainment company he founded, Lions Gate. It’s responsible for films like The Hunger Games, Divergent, Saw, and Now You See Me. Frank, of course, is well-known in the mining space, building up several multi-billion dollar mining companies, including Goldcorp.

Insiders currently own a whopping 20% of the company!

The Chairman of LIX is Paul Matysek, who, in the last 12 years, has delivered incredible value to investors who chose to partner with him in the early innings like where LIX is today.

Paul’s Recent Track Record…

[su_list icon=”icon: check” icon_color=”#0000″]

- Lithium One saw gains of over 1,500%

- Potash One gained 4,000%

- Energy Metals delivered 1,900%

[/su_list][/vc_column_text][vc_column_text][su_note note_color=”#fcfcfc” text_color=”#000″]

LIX Investors Today Are the Early Buyers of this New Paul Matysek Stock!

[/su_note][/vc_column_text][vc_column_text] His last three deals, Lithium One, Potash One, and Energy Metals each took about 3 years from conception to sale and created shareholder value of over $2 billion… LIX is in its infancy, less than 4 months old.

His last three deals, Lithium One, Potash One, and Energy Metals each took about 3 years from conception to sale and created shareholder value of over $2 billion… LIX is in its infancy, less than 4 months old.

Matysek says that the lithium industry growth rate is now so steep, with physical shortages, that unlike his previous 3 deals, he feels that the major producers are the ones that will be knocking on his door this time around.

“I think if we can demonstrate a project with any value, the LGs, Panasonics, the Teslas of the world will come to my doorstep, rather than the other way around.

There are so few places to go. They’ll be sniffing around once you have something of value. It’s a race to get into production.”

[/vc_column_text][vc_column_text][su_note note_color=”#fcfcfc” text_color=”#000″]

LIX has Two Projects located in Lithium-Rich Areas

[/su_note][/vc_column_text][vc_column_text] [su_list icon=”icon: check” icon_color=”#0000″]

[su_list icon=”icon: check” icon_color=”#0000″]

- One is the largest land position in Clayton Valley, Nevada, adjacent to and surrounding the only producing lithium project in North America!

- The second property is in the prolific “Lithium Triangle” in Argentina, covering 95% of a well-known area with positive historic economics, grade, and size.

[/su_list]When I spoke to Paul Matysek, he said that his plan was to actively pursue additional projects in order to enhance their portfolio of assets. With the U.S. importing 80% of its lithium from overseas, LIX is strategically located next to the single producing mine in the U.S.

“Lithium is the New Gasoline.” – According to Goldman Sachs

I want to position us early in this trend. With overwhelming forces behind us now, our top suggestion for this trend is Lithium X.

[/vc_column_text][vc_column_text][su_note note_color=”#fcfcfc” text_color=”#000″]

Consider shares of Lithium X (TSXV: LIX & US: LIXXF)

[/su_note][/vc_column_text][vc_column_text]Become a strategic shareholder with Frank Giustra and Paul Matysek. Both of these men — and the entire team at LIX — are very certain about what they are doing. Chairman Paul Matysek took Lithium One from 10 cents to $1.55 in 2 ½ years! He’s very familiar with all the big players in the sector, and knows exactly what needs to be done to deliver enormous value to LIX shareholders.

Behind everything the company will be doing is a trend that is now undeniable, not only from our transportation that will be powered by lithium, but renewable grid storage. Elon Musk, when they announced their new company, Tesla Energy, for homes and businesses, priced a home storage program at about $3,000.

That’s very affordable, considering it will lower your electric bill for the rest of your life!

And we all know that it won’t take long for government credits to enter into consumers buying these new home battery storage units. This will only put an added pressure on the market for these products and demand for lithium, which is already seeing a real world-wide shortage. Lithium X is the right trend, brings the perfect management team, has two ideal projects for this space, and its mission is to become the GO-TO NAME in the lithium space.

Lithium X Trades for $1.13 on the TSX-Venture Exchange (LIX) and for $0.86 on the U.S. exchange (LIXXF).

[/vc_column_text][vc_row_inner][vc_column_inner width=”1/6″][/vc_column_inner][vc_column_inner width=”2/3″][vc_column_text]

If You’re not Already a Member,

Please Enter your Email here for Updates!

[/vc_column_text][/vc_column_inner][vc_column_inner width=”1/6″][/vc_column_inner][/vc_row_inner][vc_column_text]Best Regards,

![]()

Daniel Ameduri

President, FutureMoneyTrends.com

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_separator border_width=”3″][vc_column_text]Disclaimer

FutureMoneyTrends.com is owned by Future Money Trends, LLC. The website, its owners, their affiliates, directors, officers, employees and agents are hereafter collectively referred to as “we”, “our” or “us”.

We are publishers of publicly disseminated information on behalf of our clients, most of whom are issuers or non-affiliate third party shareholders of various issuers. We receive either monetary or securities compensation for our services and are required under Section 17(b) of the Securities Act of 1933, as amended (“Securities Act”), to specifically disclose our compensation. Section 17(b) provides that:

“It shall be unlawful for any person, by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails, to publish, give publicity to, or circulate any notice, circular, advertisement, newspaper, article, letter, investment service, or communication, which, though not purporting to offer a security for sale, describes such security for a consideration received or to be received, directly or indirectly, from an issuer, underwriter, or dealer, without fully disclosing the receipt, whether past or prospective, of such consideration and the amount thereof.”

We endeavor to strictly comply by the disclosure requirements of Securities Act Section 17(b), the disclosure of which appears herein. We most often receive monetary consideration; however, we may on occasion receive securities compensation or buy and sell securities of the same security we are disseminating information for. Whether we receive cash or securities compensation, we fully disclose the receipt or anticipated receipt of such compensation. We have received fifty thousand dollars for a one week email marketing program, paid for directly by the company.

We do not act in the capacity of any of the following and you should not construe our activities as involving any of the following:

- Providing investment advice;

- Acting in the capacity of an investment adviser or engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal or state level;

- Broker-dealer activities;

- Stock picker;

- Securities trading expert;

- Securities analyst;

- Financial planner or financial planning;

- Providing stock recommendations;

- Providing advice about buy and sell or hold recommendations as to specific securities; or

- Offer or sale of securities or solicitation to purchase securities;

You should not interpret any of our publications as investment advice. If you are seeking investment advice you should consult with an registered investment adviser, registered stockbroker, or other financial professional of your choosing.

Our activities involve actual conflicts of interest, since we receive monetary or securities compensation in the very securities we are promoting and shortly after we receive the monetary compensation we promote the securities or after we receive the securities, we sell the securities during our promotional activities or thereafter.

Many of the securities we profile are considered penny stocks. Penny stocks inherently involve high risk and price volatility. You may lose your entire investment in any penny stock that you invest in. You should be acutely aware of the following information and risks inherent in any penny stock investment that you may make, including any issuer profiled on our websites or otherwise:

- We receive monetary or securities compensation from persons that claim they are a non-affiliate shareholder (“NAS”) or an issuer; however, we conduct no due diligence whatsoever to determine whether in fact they are a non-affiliate;

- We may receive free trading shares from the non-affiliates, which we may sell at anytime, including as soon as we deposit such shares in our securities accounts, during our promotion of the issuer’s stock (that the NAS owns), after our promotion, or at anytime;

- There is an inherent conflict of interest between our information dissemination services involving various issuers and our receipt of compensation from those same issuers;

- We may buy and sell securities in the securities that we provide information dissemination services, which may cause: a) significant volatility in the issuer’s stock; (b) price declines from our selling activities; (c) permit us to make substantial profits while we are disseminating profiles or information about the issuer, yet may result in a diminished value to the stock for investors;

- We conduct little or no due diligence on the profiles we receive from the non-affiliate shareholders nor do we conduct due diligence on any other information we disseminate to the public;

- We conduct no diligence on the press releases we receive from a non-affiliate shareholder, an issuer, or from a publicly available source;

- Penny stocks are subject to the SEC’s penny stock rules and subject broker-dealers to customer suitability rules and other requirements, which may lead to low volume in the securities and/or difficulties in selling the shares;

- Many penny stocks are thinly traded or have low trading volume, which may lead to difficulties in selling your securities and extreme price volatility;

- Many of the penny stocks we profile or provide information about are subject to intense competition, extreme regulatory oversight and inadequate financing to pursue their operational plan;

- The issuer profiles and information we provide represent only a small or even infinitesimal amount of information regarding the issuer and is insufficient to formulate an investment decision; as such, that information should only be a starting point from which you conduct an in-depth investigation of the issuer from available public sources, such as www.sec.gov, www otcmarkets.com, www.sec.gov, yahoofinance.com, www.google.com and other available public sources as well as consulting with your financial professional, investment adviser, registered representative with a registered securities broker-dealer;

- We urge you to conduct an in-depth investigation of the issuer from the above or other available sources, especially because we only present positive information, which is an insufficient basis to invest in any stock, yet alone a penny stock; accordingly, you should proceed with such investigation to determine, among other things, information pertaining to the issuer’s financial condition, operations, business model, and risks involved in the issuer’s business;

- The issuers we profile may have negative signs on the otcmarkets.com website (i.e. Stop Sign, No Information, Limited Information, Caveat Emptor), which you should determine from entering the symbol of the stock profiled into the otcmarkets.com website;

- You should determine whether the issuer we profile or provide information about is a development stage company, which is subject to the risks of a development stage company in a similar such business, including difficulties in obtaining financing for operations and future growth;

- You should conduct an investigation of the innumerable risks that are inherent or present in the business plan of almost any penny stock issuer; therefore, do not use our profiles or any information contained in our website or profiles as the sole determination of making an investment decision;

- We only present positive information regarding an issuer; therefore, you should conduct an in-depth investigation of any possible negative factors regarding such issuer;

- You should accept our information in an “as is” state; in other words, your use of the information is at your own risk and such information may change at anytime and it is not based upon any verification or due diligence of the statements made;

- We state that many of the stocks we profile are consistent with the future economic trends we discuss; however, future economic trends or analysis has its own limitations, including: (a) due to the complexity of economic analysis as well as the individual financial and operational characteristics of an individual issuer, such economic trends or predictions may amount to nothing more then speculation; (b) consumers, producers, investors, borrowers, lenders and government may react in unforeseen ways and be affected by behavioral biases; (c) human and social factors may outweigh future economic trends and predictions that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in such economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of fully new circumstances and situations in which uncertainty becomes reality rather then of predictive economic quality; or (f) if the trends involves a single result, it ignores all other scenarios that may be crucial to make a decision in the event of various contingencies;

- The information we disseminate about issuers contain forward looking statements, i.e. statements or discussions that constitute predictions, expectations, beliefs, plans, estimates, projections as indicated by such words as “expects”, “will”, “anticipates”, “estimates; therefore, you should proceed with extreme caution in relying upon such statements and conduct a full investigation into any such forward looking statements;

- Forward looking statements are limited to the time period in which they are made and we do not undertake to update forward looking statements that may change at anytime; and

- We make statements in our profiles that an issuer’s stock price has increased over a certain period of time since our publication of information about an issuer because such stock price reflects only an arbitrary period of time, it is of no predictive or analytical quality and you should not use any such information in your analysis of any such issuer;

Never base any decision off of our website or emails.

[/vc_column_text][/vc_column][/vc_row]